Easy & quick online bank opening. Register today!!

We’re providing the best insurance policies

Trusted by

customers

Personal account

Business account

Commercial account

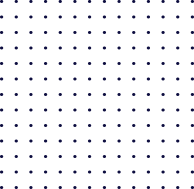

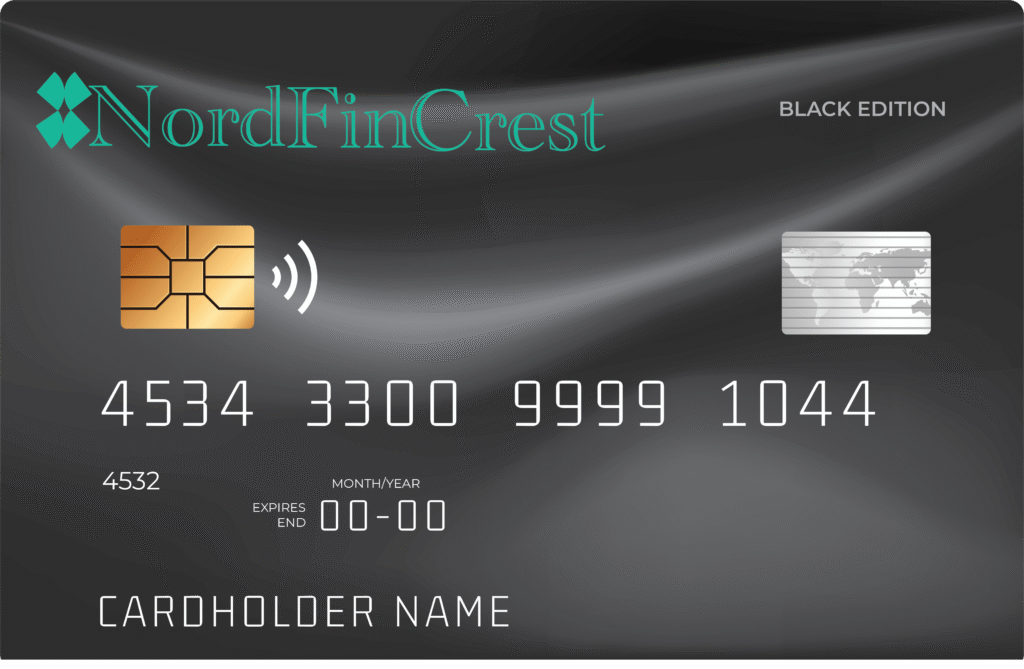

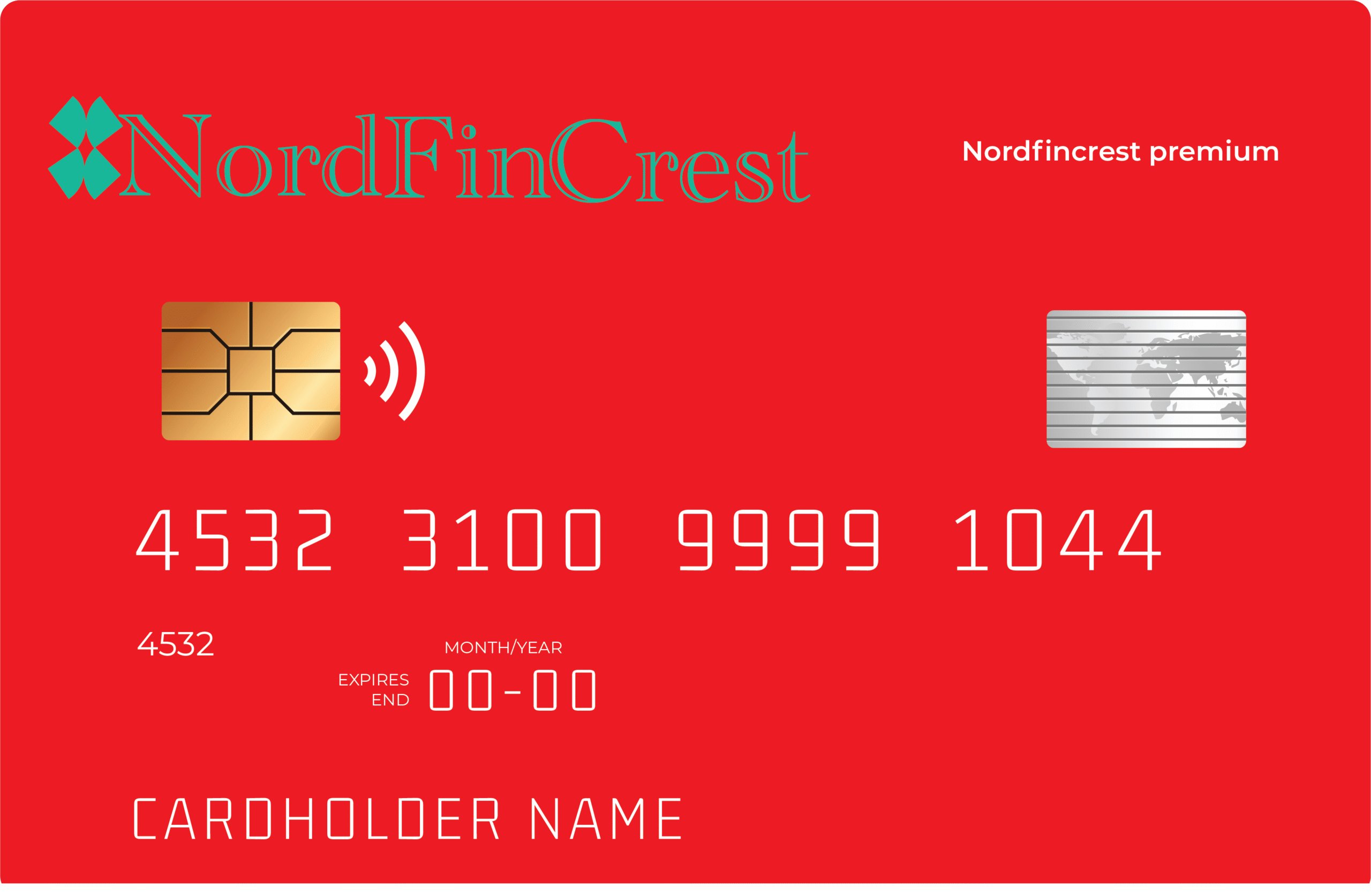

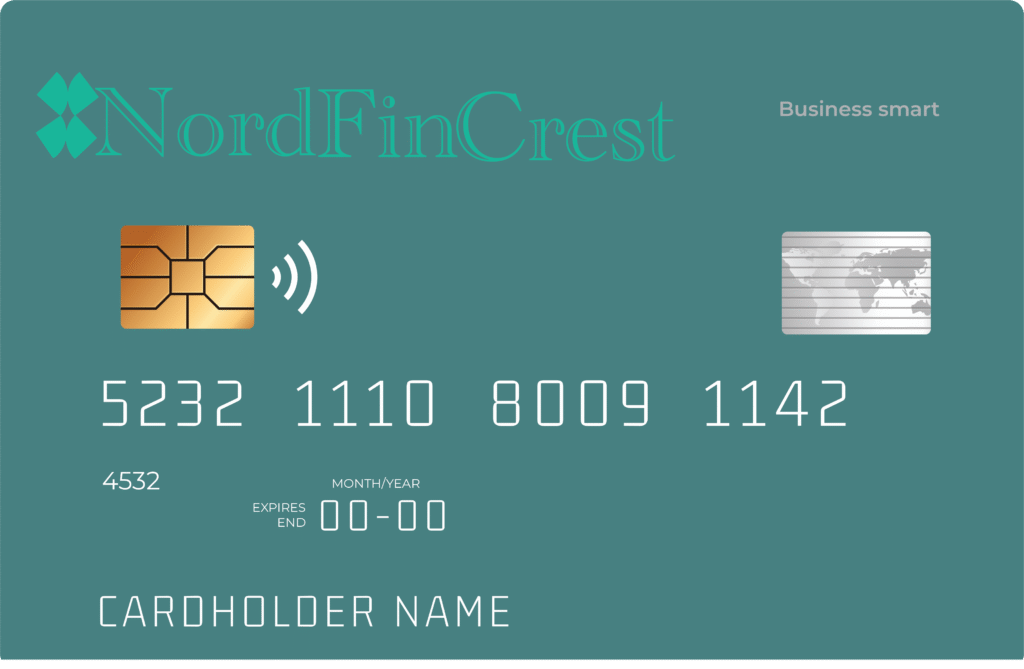

What Are the Best Credit Card Offers Right Now?

Explore our range of credit card offerings designed to meet diverse financial needs. Each card comes with unique benefits, including rewards programs, low-interest rates, and exclusive discounts, ensuring you find the perfect fit for your lifestyle.

Cardholders enjoy a range of perks, including travel insurance, concierge services & access to exclusive events. Features are designed to elevate your lifestyle.

This credit card provides a range of exclusive benefits designed to enhance your financial experience. With competitive interest rates and a generous credit limit..

Enjoy features such as travel perks, cashback options, and personalized support, all aimed at maximizing your satisfaction and convenience.

Enjoy unparalleled service and access to exclusive events, making every transaction more rewarding. this card is designed to elevate your financial experience.

Providing all the insurance services for you

Car

insurance

Life

insurance

Health

insurance

Home

insurance

Business

insurance

Travel

insurance

Evaluate our different loan options

the benefits associated with each loan can vary widely. Some loans may provide lower monthly payments, while others might offer flexible repayment schedules or the potential for loan forgiveness. By comparing these benefits, borrowers can identify which loan aligns best with their financial goals and circumstances

Offering great questions and answer for you

Guidelines for acquiring a loan

To secure a loan, begin by assessing your financial needs and determining the amount required. This will help you identify the type of loan that best suits your situation, whether it be a personal loan, mortgage, or business loan. Understanding your purpose for the loan is crucial in selecting the right lender and terms.

What defines a secure loan?

A secure loan is a type of borrowing that is backed by collateral, which can be an asset such as a home or a vehicle. This collateral provides the lender with a form of security, reducing their risk in the event that the borrower defaults on the loan. Because of this added security, secure loans often come with lower interest rates compared to unsecured loans.

What defines a secure loan?

Before proceeding with early repayment, it is advisable to assess your financial situation and ensure that doing so aligns with your broader financial goals. Consulting with a financial advisor can provide valuable insights into the best approach for managing your loans effectively.

What is home insurance?

Home insurance is a type of coverage designed to protect homeowners from financial losses related to their property. It typically covers damages to the home itself, personal belongings, and liability for injuries that occur on the property. This insurance serves as a safety net, providing peace of mind in the event of unforeseen incidents such as natural disasters, theft, or accidents.

Is home insurance necessary while renting a property?

Renters insurance offers coverage for personal items in the event of theft, fire, or other disasters. It can also include liability protection, which safeguards against claims if someone is injured in the rented space. This type of insurance is often affordable and can be a wise investment for those looking to protect their assets.

What happens if I make a claim and I have both Life and Critical Illness Cover?

When you file a claim while holding both Life and Critical Illness Cover, the outcomes can vary based on the specifics of your policies. Typically, each type of coverage serves a distinct purpose; Life Cover provides a payout upon death, while Critical Illness Cover offers financial support if you are diagnosed with a serious illness. Understanding the terms of each policy is crucial to determine how they interact during the claims process.

Can I cash in a plan, bond or life policy?

Before proceeding, it is advisable to consult with a financial advisor to understand the potential tax implications and how cashing in might affect your long-term financial goals. This will help ensure that you make an informed decision that aligns with your overall financial strategy.

do you offer credit cards services?

Our offerings include a range of options tailored to meet various financial needs. For more information on our credit card services, please feel free to reach out.

Are you ready?